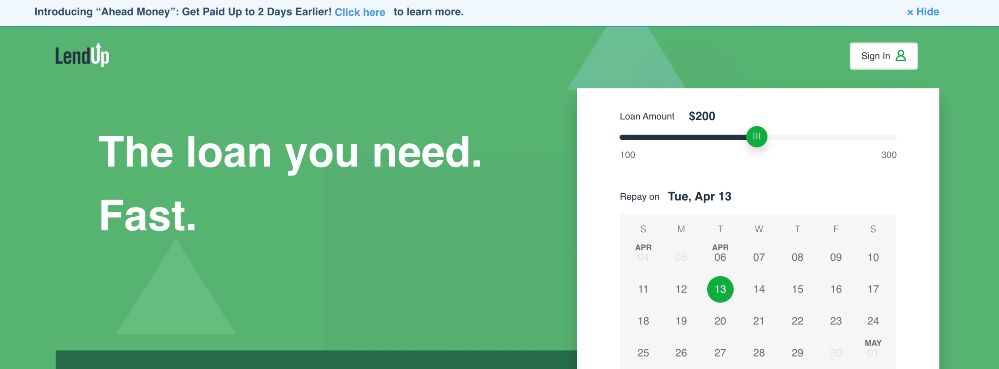

You know that sinking feeling when you hop in your car to go to work and make more money, and it won’t start? It’s unplanned, but you have to pay to get it fixed. In this Lendup.com review, you’ll see if it’s a practical option to use to get up to $500 for unexpected bills.

When an emergency happens, you need your money right now. Lendup.com’s fast loan application and quick approval processes make it possible to get your money as soon as the next business day. You may have to pay a premium for convenience, but you get the cash when you need it.

Lendup.com bills itself as the alternative to payday loans. They have developed a system called the LendUp Ladder. As you take out loans with the company or study their financial planning lessons, you gain points that help you get future loans.

Table of Contents

- General Information About Lendup.com

- The Pros Of Lendup.com

- The Cons Of Lendup.com

- Overall Reputation & Reviews For Lendup.com

- Q&A For Lendup.com

- Conclusion

General Information About Lendup.com

Did you know that almost 50% of American families couldn’t cover a surprise $400 expense? To compound this issue, over 50% of people have subprime credit scores. Lendup.com was founded in 2011 on the principle that everyone should be able to get help achieving financial health.

They wanted to make sure that families in need had a chance to get a loan without passing a credit check. They also wanted to provide affordable ways for people to build up their credit and learn how to make wiser credit decisions in the future.

Today Lendup.com offers customers no credit check loans that are designed to keep them out of debt. They have no hidden fees that can ruin a budget plan. They also offer online courses that help teach customers about finances to learn how to improve credit scores.

Lendup.com has helped over six million customers, and they are helping more every day get the money they need.

The Pros Of Lendup.com

- Money as Fast as the Next Business Day

- No Credit Check Loans

- No Hidden Fees

- The LendUp Ladder

- Access to Finance Classes

Money as Fast as the Next Business Day

One of the reasons you look for a short-term loan is because you need money quickly. With Lendup.com, the whole application and decision process can take less than 30 minutes to complete. If you are approved, they can deposit the money the next day.

If you apply for the loan before 5 PM and get approved, you can have the money in your account the next business day. Knowing how quick the money can get to you can help you with some of your anxiety during the process.

Once your application is accepted, it will just take a signature to get the funds transferred. At this time, you find out all the details of your loan, so make sure you understand what the terms are before you sign.

No Credit Check Loans

Lendup.com knows that not everyone has an excellent credit history. Many factors can go into having a poor credit score, and they don’t always reflect how reliable a person is. That’s why they don’t use credit scores when determining if you get a loan.

All you need to apply for a loan is a bank account to receive the funds and proof of some form of income. They will need your Social Security Number for identification reasons, but they will not use it to access your credit score.

Using Lendup.com can help improve your credit score. The loan can be very beneficial for your credit if you have no credit history or minimal history. As long as you make your payments on time, you may start seeing some credit rehab.

No Hidden Fees

Lendup.com prides itself on being very transparent with its fees. However, that doesn’t mean that you don’t have to read the terms of the loan. They list all fees and penalties that are possible for every loan.

No hidden fees mean that they don’t place the costs in a hard-to-understand legal speech on the tenth page of your contract. All prices and penalties are available for you to see in an easy-to-read format.

One way they help you avoid fees is by being available for contact if there is going to be a problem. When you first think there may be an issue paying off a loan, contact them immediately so they can work with you to solve the problem.

The LendUp Ladder

The LendUp Ladder is a loyalty program that Lendup.com offers. With the program, you earn points every time you make a loan payment on time, take a course that they provide, or share your story.

As you climb the LendUp Ladder, you will be able to take out larger loans. The ladder is tailored to your specific financial needs, so your path can change depending on what topics you feel you need to learn the most about or what options will best help you with your financial future.

The LendUp Ladder is also customized for your home state. Each state has different rules that can change how your ladder reacts to certain things. Check out your ladder when you get your first loan to see how you can climb it and what rewards you can get.

Access to Finance Classes

Lendup.com offers classes that you can take to help you better understand finances and loans. These classes are on a range of topics. These include courses on budgeting, credit cost, building your financial future, and understanding your finances.

The course shows an animated video to help make learning a bit more fun. Lendup.com also offers users a quiz after the video to help them understand the video’s essential concepts. The tests are used to get points for the LendUp Ladder as well.

The courses are accessible to everyone, and you can view them without being a customer of Lendup.com. They can offer great insight and resources if you are trying to understand your finances better.

VIDEO: Google Business Spotlight For LendUp

The Cons Of Lendup.com

- High Fees on Loans

- Lower Loan Amounts Than Other Options

- Doesn’t Always Help Your Credit

- Only Available in Seven States

High Fees on Loans

Lendup.com offers some features that help them stand apart from some other payday advance companies, but in the end, their interest rate and loan fees are still really high. You are paying a premium for the speed and the fact that they make loans without credit checks.

When you look at a Lendup.com comparison with other companies, you see that their rates are not the highest, but they are still higher than some traditional options out there. If it is not an emergency and you have time to research, there may be more fiscally responsible alternatives available.

Lower Loan Amounts Than Other Options

The loan amounts available with Lendup.com are not as large as some other paycheck advance companies out there, especially if you are a first-time lender. They limit the money available to you at first to help make sure you can pay it off.

You max out at $500 for the highest loan available with Lendup.com. However, most loans from the company tend to be closer to the $300 amount. With some competitors in the same state, you can get up to $1,200.

This limit is a good idea as long as you are getting enough money upfront for the expenses you are looking to cover. It can help you get approved when other companies might turn you down.

However, if you are looking for more money right away for a specific need, it may be better to look elsewhere. There are options out there that offer higher loans.

Doesn’t Always Help Your Credit

Lendup.com doesn’t always send information about your credit score. While this can be good if you are running behind on a payment, it also means that you may not improve your credit if you are paying on time every week.

With every loan you take, paying it off on time can help you build credit. It can be beneficial if you have no credit at all, and it can be a huge help when you’re starting to fix poor credit. For this to work through, the lending company has to give reports about your payments.

Paycheck advances aren’t always the best way to improve credit, but you want to see whatever positive impact they may have when you use them properly.

Only Available in Seven States

Lendup.com isn’t available nationwide. They only service seven states. If you don’t live in one of these states, you won’t be able to use their loan programs. It isn’t the least amount of states for short-term loan companies, but it also isn’t the best.

If you live in one of these states, Lendup.com may be a good option for you. However, if you’re from one of the other 43 states, you will have to look elsewhere.

Overall Reputation & Reviews For Lendup.com

Lendup.com has a pretty good reputation for a loan company online. Most of the site reviews are positive, and many people report having a good experience with the company overall. They consistently score better than three stars on multiple different review sites.

When you look at Lendup.com ratings by their customers, you notice a few common themes. Customers like how fast and easy the service is to use. They are amazed at how quickly they could go from applying to the money being in their bank account.

When there are bad reviews for the company, they focus on the company being unwilling to work with customers on late payments, which is a common complaint with loan companies.

The unique criticism for Lendup.com is being denied a loan after having paid off other loans with the company. Many users complain that the acceptance rate seems strange to them. It is something to consider when you are applying for a loan.

Q&A For Lendup.com

Here are some popular questions and answers that people often search in a Lendup.com review.

Which States Does Lendup.com Operate In?

Lendup.com operates in seven different states. Depending on the state you get your loan in, your total amount, fees, and terms can change drastically, so you will want to study your loan agreement for the state where you live.

- California

- Louisiana

- Mississippi

- Missouri

- Tennessee

- Texas

- Wisconsin

Which Type Of Loans Does Lendup.com Offer?

The type of loan that you can get with Lendup.com depends on your home state. They can only offer certain loans in specific locations. The two types of loans that are available are single-payment and installment loans.

You can get a single-payment loan in California, Louisiana, Mississippi, Missouri, Tennessee, Texas, and Wisconsin. Your state determines the exact terms and rates. These loans are paid off with one payment during a 30 day period. You usually pick the due date to coincide with payday.

In Louisiana, Missouri, and Texas, you can get installment loans. These loans let you pay back the amount over a series of scheduled payments. The installments can help you spread out the payback processes over multiple smaller payments. The exact time you get depends on the loan.

With some loans from Lendup.com, you can choose to get a debit card for your payment. You may have to pay a fee for this option when it is available.

How Do I Qualify For Lendup.com Loans & Do They Require A Credit Check?

To qualify for a Lendup.com loan, you have to be 18 years or older, live in one of the seven states that Lendup offers credit in, have a bank account to accept deposits, and be able to prove income of some kind. Proof of income can sometimes include checking stub info or bank records.

Income can include a job, pension, or social security as long as you receive consistent pay that can be verified.

Lendup.com doesn’t need to run a credit check on you. Your credit score doesn’t affect your ability to get a loan with them. They specialize in offering loans to people who have subprime or no credit scores at all.

You can apply for the loan without negatively affecting your credit score, which can be helpful if you are in the process of rebuilding your credit.

You do have to provide your Social Security Number. It isn’t used to pull your credit, but it is used to help verify your identity. The site uses the same security as banks, so Lendup.com will protect your information from online threats.

The application process for Lendup.com only takes about 15 minutes. You will receive a decision within another 15 minutes. If you have any problem with the application, the company offers customer service to help you.

How Much Does Lendup.com Cost?

The cost of Lendup.com can vary widely depending on the state you are getting the money. Due to each state having its own laws and terms, you may want to look at Lendup.com’s rate and terms page to ensure you get all the info for your state.

Loans in California can be up to $255 over 30 days. You will be charged up to 15% on the loan repayment amount.

In Louisiana, for a short-term loan, you can get up to $300 over 30 days. The fee is up to 16.75% of the repayment amount or $45, whichever is less expensive. For an installment loan, you can get $400 over four months. The fees are based on the length of the loan.

For Mississippi, you can get up to $300 over 30 days. The fee can be up to 20% of the loan amount.

Missouri has both single-payment and installment loans. For single-payment, you can get up to $300 for 30 days. You can get charged up to 25% of the amount of the loan. For Installment loans, you can get up to $400 over four months. The fee depends on the time of your loan.

A single-payment loan in Tennessee, you can take $300 over 31 days. You can be charged up to 15% of the repayment amount.

You can get up to $300 over 31 days on single-payment and up to $500 over four months with installment in Texas. Texas rates can vary more than in other states, so you will want to read your specific loan terms before accepting any offer.

For Wisconsin, you can take up to $300 over 30 days. You can get charged up to 25% of the amount of the loan.

Conclusion

If you are in an emergency and need to get a quick loan for up to $500, Lendup.com can help you out. This Lendup.com review shows how you might pay extremely high rates, but very few other options can get you the money as quickly when you need it the most.

Lendup.com offers courses and resources that can help you learn more about finance as well. You can get the money you need and learn more about staying out of this situation in the future.

With their LendUp Ladder, you can get rewarded for being a reliable customer and learning from their resource center. You can save money on future loans if you become a returning customer for Lendup.com.