So, you want to save money on bills, but you don’t want to give up your current lifestyle to do so? Welcome to the world that 99% of us live in. Most of us with a decent internet connection have considered canceling our cable service at one point or another. Those of us who live near neighbors with a WiFi network that is not secured may have even considered canceling our internet. In the long run, though, these always remain thoughts in the back of our head. We never actually pull the trigger.

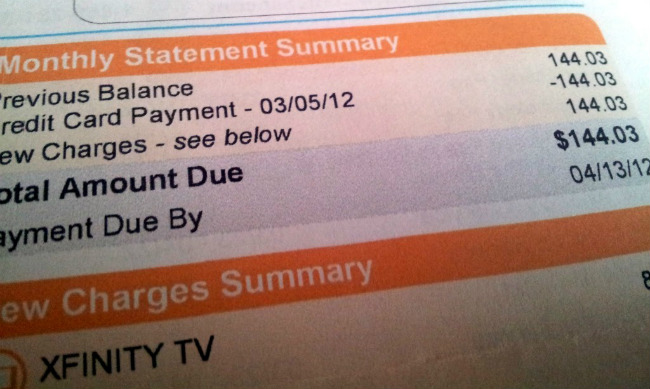

This has caused a love/hate relationship with cable, internet, and other utility companies out there. We love the services, but it seems like they never stop jacking up the bills. When I get my DirecTV bill in the mail I want to throw up. Oh, sure, the package I signed up for is the price they promised. I had a nice low introductory rate for the first year, then my DirecTV bill went through the roof! That, I expected. What I didn’t expect was all the ridiculous fees that add up. Something about an excise fee, a receiver box rental fee, some tax here, some service fee there… It just feels like they are ripping me off.

Keep Your Existing Services (And Lifestyle) But Pay Less

If you could save about 35% off of your existing bills, for doing almost nothing, would you? A new startup service is basically offering just that. If you submit your bills to this service, they will call up your providers and lower your bills for you. The real question is, how do they help you save money on bills?

First, you send the the latest copy of your bills. This can include your cell phone bill, cable bill, satellite radio bill… whatever. They will take a look at them all. About 90% of the time, they can save you an average of 35% off of your bills. If they don’t save you anything, you don’t pay. If they do save you money, you split the savings down the middle for the first year.

When I first heard you had to split the savings with them, I was a bit hesitant. I mean, why couldn’t I just do all of that myself? First of all, they have a 90% success rate compared to a less than 50% success rate when people try to call themselves. Second, they know about deals and packages that are not publicly advertised, so they can usually get you a better service package than you can. Third, once you submit your bills, they do all the work. They deal with customer service phone trees, disconnects, transfers, and however much time it takes them to succeed. Do you really want to spend hours of your life on the phone haggling with customer service reps?

If you give them $200 worth of monthly bills and they reduce that by their average of 35%, you are saving $840 in your first year. You split that first year with them, so that’s $420 that you get to keep. After the first year, you keep it all. They also allow you to pay them monthly for that first year so that you are never actually out of pocket any money. The service literally pays for itself.

Other Alternatives To Save Money On Bills

You can always save money on bills by doing all the legwork yourself. If you own Comcast, DirecTV, AT&T, Verizon, or any of the other large cable, internet, and TV providers, GOOD LUCK! They have made the process of negotiating lower bills very difficult. That’s the entire reason why Bill Fixers was able to start their business. Make sure you set aside at least an hour for each phone call. Also be prepared to call back a few times if you don’t succeed at first. Getting the right customer service rep is a game of luck.

As a last resort, you can reign in your lifestyle a little bit. Maybe it is time to get rid of your cable TV. Sports games can be watched and enjoyed at friends houses, otherwise, most TV shows are now available with streaming services like Netflix and Hulu. Maybe you can lower the data plan on your phone or reduce your home internet speed. Almost all of us can cut waste from our spending, so you just need to determine how much the things you pay for are really worth to you.

It isn’t easy to save money on bills. It’s way easier to spend money than save it, but sometimes when we’re in a crunch, we don’t have any options. I hope the suggestions and services above will help you to save money on bills, and of course, I’m always open to comments and ideas from readers like you!